wake county nc sales tax rate 2019

North Carolina has a 475 sales tax and Wake County collects an additional 2 so the minimum sales tax rate in Wake County is 675 not including any city or special district taxesTax Rates By City in Wake County North Carolina. Proof of plate surrender to NCDMV DMV Form FS20 Copy of the Bill of Sale or the new states registration.

King County Wa Property Tax Calculator Smartasset

The corporate income tax rate for North Carolina is 40.

. On July 1 2011 Announcements Leave a comment Leave a Reply Cancel reply. The 725 sales tax rate in Wake Forest consists of 475 North Carolina state sales. The median property tax in Wake County North Carolina is 1793 per year for a home worth the median value of 222300.

This table shows the total sales tax rates for all cities and towns in Wake. 3 rows Sales Tax Breakdown. The North Carolina state sales tax rate is currently.

There is not a local corporate income tax. TAXING UNIT 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012. 4 rows Rate.

85 x 7027 5973 estimated annual tax. 6 rows The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina. Walk-ins and appointment information.

APEX 39 38 415 415 38 38 39. WAKE COUNTY 160 60 7207 6544 615 6005 6145 578 534 534. Nearly all of these increases stemmed from ballot measures though local government officials in Wake County North Carolina of which Raleigh.

The Wake County sales tax rate is. The Wake County North Carolina Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Wake County North Carolina in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Wake County North Carolina. The state will phase-in a single sales factor in the 2016 and 2017 tax years with a 100 sales factor imposed in the 2018 tax year.

Wake County North Carolina Mon 14 Oct 2019 - 429 PM ET The countys AAA Issuer Default Rating IDR and GO rating reflect its strong revenue growth prospects ample reserves and broad budgetary tools along with solid expenditure flexibility and. Wake County collects on average 081 of a propertys assessed fair market value as property tax. Appointments are recommended and walk-ins are first come first serve.

The total sales tax rate in any given location can be broken down into state county city and special district rates. And local sales tax rates over the past two years including 10 with increases in the first half of 2019. Historical County Sales and Use Tax Rates Effective Dates of Local Sales and Use Tax Rates in North Carolina Counties as of April 1 2019 Effective Dates of Local Sales and Use Tax Rates in North Carolina Counties as of April 1 2019.

3 rows Sales Tax Breakdown. The 2018 United States. Wake County Sales Tax Rate 2019 Coupons Promo Codes 11-2021.

Sales and Use Tax Rates Effective April 1 2019 NCDOR. Yearly median tax in Wake County. Pamlico County Tax Rates County.

FY2018-19 Property Tax Rate per 100 Value 06544 2018Q4 Licensed Child Care Facilities 503 FY2017-18 Annual Taxable Retail Sales mil 182737 2018Q4 Licensed Child Care Enrollment 26530 2019 Tier designation 3. 6 rows The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina. ANGIER 253 53 53 53 53 53 53 53 53 53.

Within one year of surrendering the license plates the owner must present the following to the county tax office. Wake County has one of the highest median property taxes in the United States and is ranked 571st of the 3143. GET THE LATEST INFORMATION Most Service Centers are now open to the public for walk-in traffic on a limited schedule.

The corporate income tax rate for North Carolina will drop to 30 starting January 2017. County Profile Wake County NC December 2019 Demographics Population Growth Population Annual Growth 2017 Est Population 1023811 25 2010 Census Total Population 900993 44 Jul2018 NC Certified Population Estimate 1070197 UrbanRural Representation UrbanRural Percent 2010 Census Total Population. That makes the countys average effective property tax rate 088.

County rate 60 Fire District rate 1027 Combined Rate 7027 No vehicle fee is charged if the property is not in a municipality Property value divided by 100. The minimum combined 2022 sales tax rate for Wake County North Carolina is. Wake County collects on average 081 of a propertys assessed fair market value as property tax.

NC Sales Tax Rate returns to 675 in Wake County today July 1 2011. Any municipal vehicle tax assessed in accordance with NC General Statute 20-97 is not subject to proration or refund. This is the total of state and county sales tax rates.

Nc sales tax rate wake county. North Carolina has a 475 sales tax and Wake County collects an additional 2 so the minimum sales tax rate in Wake County is 675 not including any city or special district taxes.

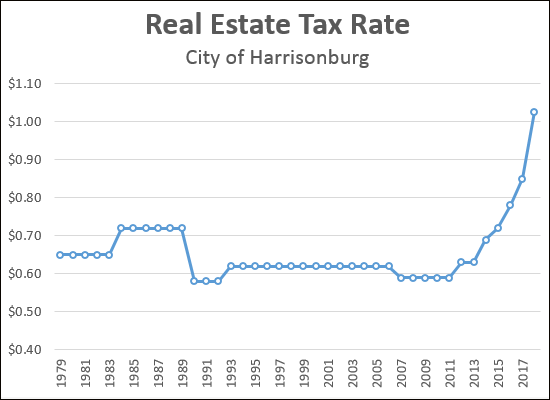

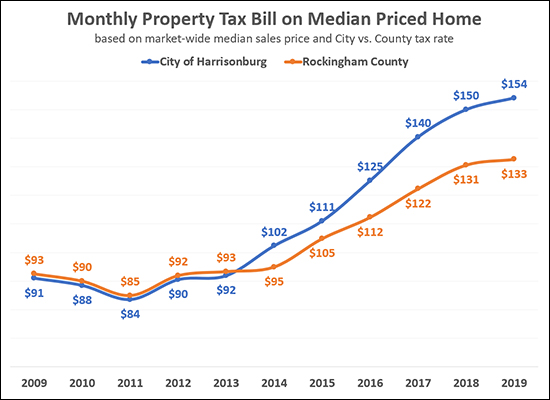

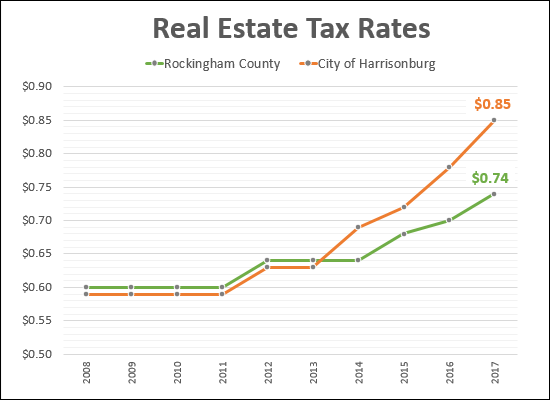

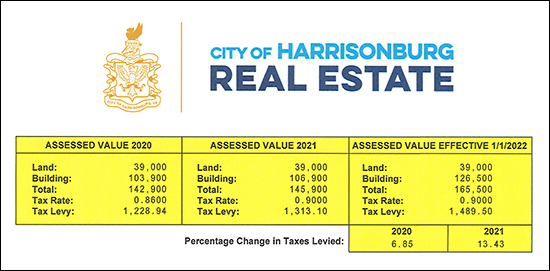

Assessments Harrisonburghousingtoday Com Market Updates Analysis And Commentary On Harrisonburg And Rockingham County Real Estate

North Carolina Nc Car Sales Tax Everything You Need To Know

Morrisville North Carolina S Sales Tax Rate Is 7 5

Assessments Harrisonburghousingtoday Com Market Updates Analysis And Commentary On Harrisonburg And Rockingham County Real Estate

Assessments Harrisonburghousingtoday Com Market Updates Analysis And Commentary On Harrisonburg And Rockingham County Real Estate

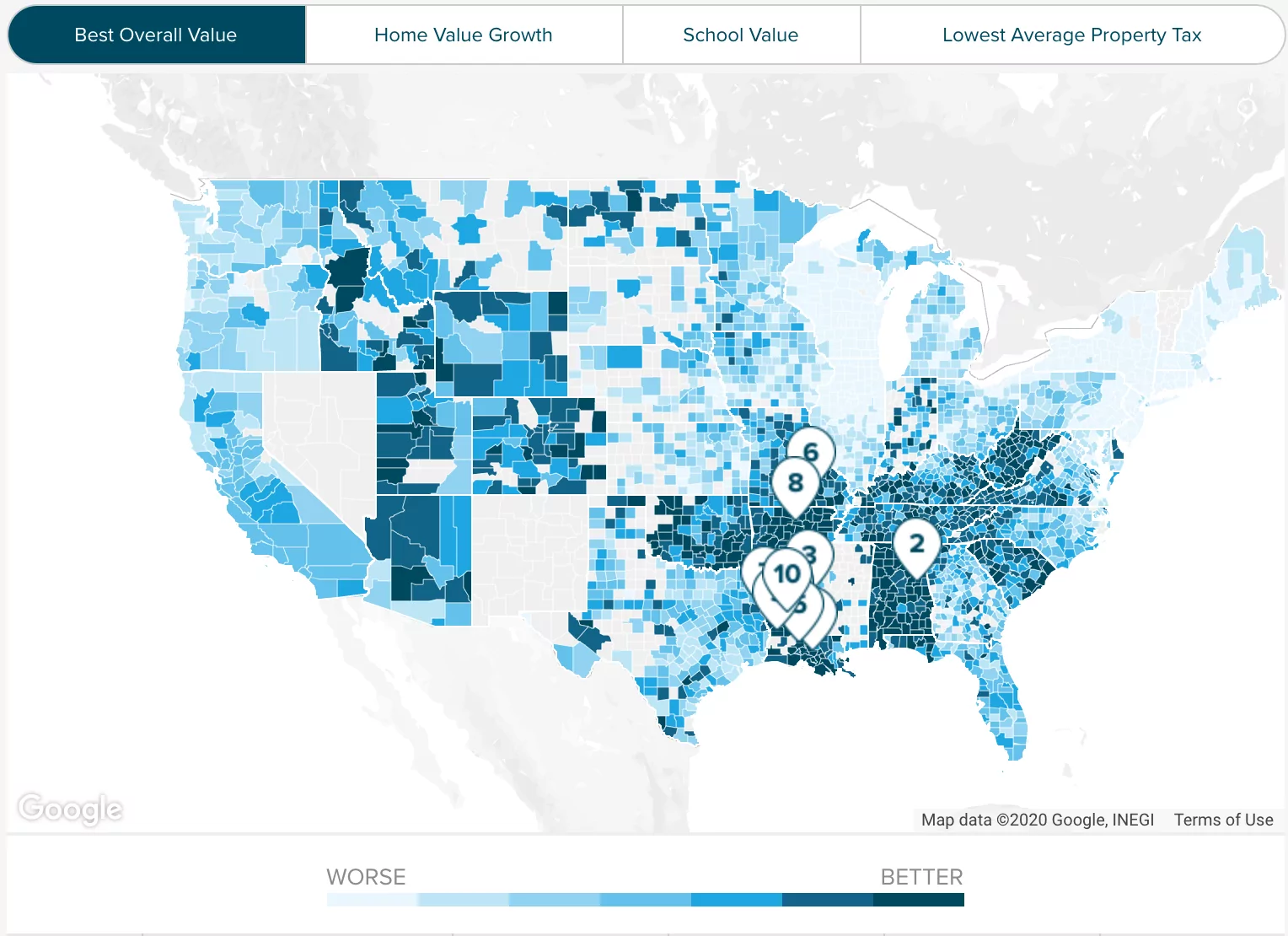

Property Taxes By State Embrace Higher Property Taxes

Property Taxes By State Embrace Higher Property Taxes

Assessments Harrisonburghousingtoday Com Market Updates Analysis And Commentary On Harrisonburg And Rockingham County Real Estate

Assessments Harrisonburghousingtoday Com Market Updates Analysis And Commentary On Harrisonburg And Rockingham County Real Estate

Property Taxes By State Embrace Higher Property Taxes

Selling A Home Held In A Trust Is All About Timing

Calculating Federal Taxes And Take Home Pay Video Khan Academy

Taxes Chatham County Economic Development Corporation

.png)